Futures Rise Amid Tech Gains and Tariff Uncertainty

U.S. stock futures increased, as investors responded to recent developments in trade policy and economic indicators. The rally was led by technology stocks, notably Apple, following the White House’s announcement that certain electronics, including smartphones and computers, would be temporarily exempt from new tariffs. However, the Trump administration indicated that these products would still be subject to smaller levies imposed earlier this year and vowed to review the “whole electronics supply chain,” leaving investors cautious about the future of trade relations with China.

The temporary tariff exemptions provided a boost to tech stocks. Apple’s share price rose, while other tech giants like Nvidia and Dell also saw gains. The Nasdaq 100 futures increased, reflecting investor optimism in the technology sector. Despite the positive movement, Commerce Secretary Howard Lutnick emphasized that these exemptions are temporary and that a national security investigation into tech products is forthcoming, adding a layer of uncertainty to the market.

China’s Exports Surge Amid Tariff Concerns

China’s exports experienced a significant surge in March, increasing by 12.4% compared to the previous year. This uptick is attributed to U.S. importers rushing to secure goods before the anticipated implementation of new tariffs. The trade surplus for March reached $102.64 billion, surpassing expectations and indicating strong global demand for Chinese products.

Economic Indicators Signal Potential Recession Risks

Recent research from the Federal Reserve Bank of San Francisco highlights potential recession risks, citing a slow but steady increase in the U.S. unemployment rate from 3.5% in mid-2023 to 4.2% last month. More concerning is the rising median duration of unemployment, which has increased from approximately 8 weeks to over 10 weeks since mid-2022, mirroring patterns observed before past recessions. These indicators suggest underlying weaknesses in the labor market that could impact economic growth.

Market Volatility and Investor Sentiment

The stock market has experienced heightened volatility since President Trump’s announcement of sweeping tariffs on April 2. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all saw significant declines, with the Nasdaq entering bear market territory. While recent rallies have provided some relief, major indexes remain below their pre-tariff levels, and investor sentiment remains fragile.

Technical Analysis: “Death Cross” Looms

Technical analysts are monitoring the S&P 500 for a potential “death cross,” a pattern that occurs when the 50-day moving average crosses below the 200-day moving average, often signaling further downside. While some strategists caution that this pattern may not necessarily predict significant losses, it adds to the prevailing uncertainty in the market.

Global Trade Tensions and Policy Uncertainty

The evolving trade policies have created a complex environment for investors. While some tariff exemptions have provided short-term relief, the lack of clarity regarding future tariffs on semiconductors and other electronics keeps markets on edge. The administration’s approach to trade policy remains fluid, with potential for both escalation and de-escalation, making it challenging for businesses and investors to plan effectively.

Final Thoughts: Futures

While the recent rally in tech stocks offers a glimmer of optimism, the underlying economic concerns and policy uncertainties suggest that caution remains warranted. The trajectory of the U.S. economy and the stability of global markets will depend on the resolution of trade tensions and the effectiveness of policy measures to address emerging economic challenges.

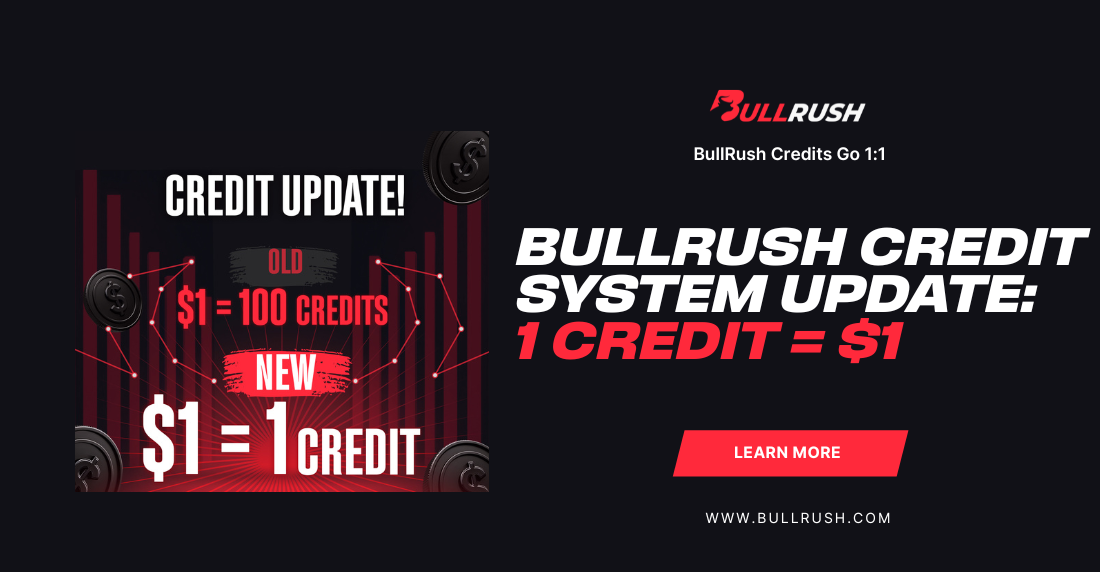

As economic uncertainty grows, traders need to adjust their strategies. BullRush offers a gamified platform that allows traders to develop their skills through engaging trading challenges and competitions.