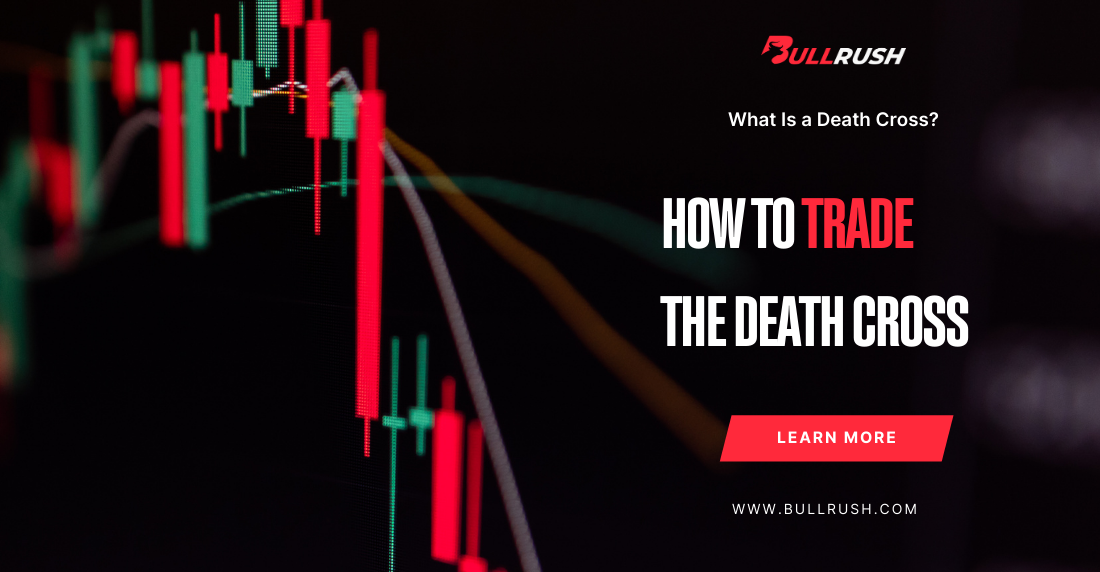

How to Trade the Death Cross: A Strategic Guide

How to Trade the Death Cross

When traders hear the term “death cross,” it sounds like something out of a financial horror film. But despite its ominous name, this technical pattern is less of a death sentence and more of a warning shot. Understanding how to interpret and trade the death cross can help you avoid emotional decisions and even profit from the confusion.

What Is the Death Cross?

A death cross occurs when a short-term moving average, typically the 50-day, crosses below a longer-term moving average, usually the 200-day. This crossover is seen by many traders and chart watchers as a bearish signal, suggesting potential for a continued downturn or the exhaustion of a recent rally.

But historical data paints a more nuanced picture. In many cases, the death cross has been followed not by prolonged crashes but by short-term recoveries and even strong rallies.

What Does It Actually Mean?

Think of the death cross as a summary of the last few months of price action:

- The 50-day moving average represents short- to mid-term momentum.

- The 200-day moving average reflects long-term trend stability.

When the shorter average dips below the longer one, it simply tells us that recent performance has weakened compared to the broader historical trend.

April 2025: Death Cross

On April 14, 2025, the S&P 500 closed with the “death cross” formation when its 50-day moving average fell below the 200-day moving average. The technical indicator can be interpreted as a potential shift from a bull to a bear market trend.

Adam Turnquist, chief technical strategist of LPL Financial, believes that the current market situation is akin to the period of 2018 and 2020 when V-shape recoveries happened likewise. He refers to market capitulation indicators as an indication that pressure selling must be subsiding. Paul Ciana, Managing Director and Head of FICC Technical Strategy Research at Bank of America, states that historical data indicates that 30 days after an S&P 500 death cross, the index has risen 60% of the time, with an average gain of 0.8%. However, 20 days post-death cross, the S&P 500 has declined 52% of the time, averaging a 0.5% loss.

When the Death Cross Works Best

While the death cross on its own isn’t a magic sell signal, it does carry more weight in specific contexts:

- During Established Downtrends: If the market is already down 20% or more, the death cross can act as a confirming signal that selling pressure is likely to continue. This is when fundamentals may be deteriorating alongside technicals.

- With Additional Confirmation: Use supporting indicators such as RSI, MACD, or volume divergence. If momentum indicators also show bearish signals, the death cross becomes more actionable.

- In High-Volatility Environments: When fear drives markets, death crosses tend to stir panic and shift investor behavior. That makes them more powerful as psychological signals, even if not perfect predictors.

Trading the Death Cross

Let’s walk through a strategic approach to trading the death cross.

- Wait. Don’t Panic Sell: When the death cross triggers, don’t react impulsively. Recognize it as a signal of past weakness, not necessarily future declines. Let the market stabilize or confirm with additional price action.

- Confirm with Context: Before acting, assess:

- Overall market trend (is this part of a broader bear market or just a correction?)

- Macro factors (interest rates, inflation, earnings season)

- Price action (support/resistance, volume spikes)

Confirmation is key.

- Use a Two-Part Plan: If you’re a swing trader or short-term investor, consider this two-phase approach:

Phase 1: Defensive Play

- Tighten stop-losses on long positions.

- Take partial profits.

Phase 2: Opportunistic Entry

- Watch for a double bottom, oversold RSI, or bullish divergence.

- Enter cautiously with defined risk, targeting mean-reversion or snapback rallies.

- Position for Mean Reversion: Given that the death cross often signals a market that’s already been beaten down, look for opportunities to go long once selling momentum fades.

- Track Golden Cross Reversals: Eventually, the inverse may occur, the golden cross, when the 50-day climbs back above the 200-day. This crossover often signals a longer-term uptrend and can validate the success of your earlier accumulation trades.

Real-World Examples

Let’s look at two death cross outcomes:

- March 2020 (COVID crash): S&P 500 forms a death cross mid-panic. But one year later, it’s up over 50%.

- March 2022 (Rate hike fears): Death cross forms. Six months later, the S&P 500 dips ~7% before recovering.

Takeaway? Same signal, different outcomes.

Final Thoughts

The death cross isn’t the end of the world, it’s a signal that the market is experiencing short-term weakness. Use it as a framework for caution, not fear. With the right tools and mindset, it can be a profitable part of your trading.

So next time you see a death cross flashing across your chart, don’t run, but analyze. Because sometimes, the best trades come right after the scariest headlines.